Factor investing is the basis for Everon’s investment strategy. The fundamental premise of this investment approach is to identify specific factors that explain asset returns beyond traditional market risk. These factors, such as Value, Momentum, Size, and Quality, have been widely studied and recognized as drivers of asset performance.

This article analyzes the recent developments in Value, Momentum, Size, and Quality factors using data from the Kenneth R. French Data Library. By doing so, it aims to provide valuable insights regarding the dynamic nature of these factors and their potential impact on portfolio management and risk assessment.

Kenneth R. French is a researcher in the area of factor investing and provides precalculated factor data on his website. He became famous for the publication of the “Fama and French Three Factor Model” together with the Nobel Laureate Eugene Fama in 1992.

The factor data is constructed as long-short portfolios with the intend to extract the pure factor without effects driven by the market. This is the academic approach of factor construction and gives a good indication of the factor itself. However, in practice factors are used slightly differently in portfolio construction.

Contents

Value Factor

Value investing involves buying undervalued securities with the expectation that they will appreciate over time. The Value factor has historically been one of the most prominent factors in explaining asset returns, but has lost importance within the last decades. Recently, however, the Value factor has experienced a resurgence of interest, as investors question the sustainability of growth-oriented strategies in the face of changing market conditions.

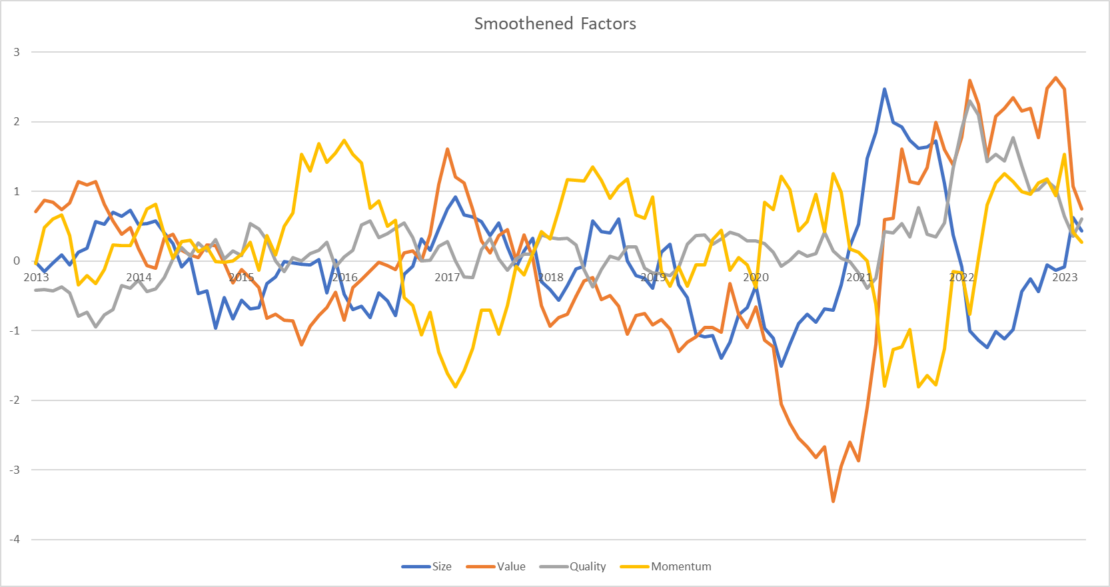

Using data from the Kenneth R. French Data Library, the Value factor has exhibited a notable shift in recent years. From 2015 to 2019, the Value factor underperformed, but in 2020 and 2021, it experienced a remarkable comeback. This can be attributed to several factors, including the market’s reaction to the COVID-19 pandemic, the subsequent economic recovery, and the reorientation of investor focus towards value-oriented strategies.

This orientation towards value remained strong in 2022, as the insecurity about the impact of the higher interest rate regime on the economy persisted. With the beginning of this year, we see already a shift back from value towards growth again. Even though the factor was on average negative for the last decade, value is still the go-to factor in times of crisis. Therefor it should still find its consideration in an asset managers investment decision.

Momentum Factor

Momentum investing involves taking long positions in assets that have exhibited strong recent performance and short positions in assets that have underperformed. The Momentum factor is based on the notion that assets with strong past performance tend to continue outperforming in the short term. The Momentum factor has been well-documented in academic literature, and it has been a popular strategy among both individual and institutional investors.

The Momentum factor has been relatively consistent over the past decade with a positive premium on average. Despite short-term fluctuations, the Momentum factor has generally maintained its ability to generate excess returns for investors. However, the factor has experienced some periods of underperformance, such as during the market turmoil induced by the COVID-19 pandemic.

Especially when markets exhibit high volatility with fast change of directions, momentum becomes instable. Since mid-2021 to the end of 2022, momentum was a strong factor, but with the tech rally in the first months of 2023, the overall momentum factor weakened again.

Size Factor

The Size factor, also known as the small-cap premium, posits that smaller companies tend to outperform larger companies on a risk-adjusted basis. This factor has been extensively studied and has shown to be a persistent driver of asset returns. However, the Size factor has experienced some fluctuations in recent years, raising questions about its long-term stability.

The Size factor has shown mixed performance over the past decade. While small-cap stocks have generally outperformed large-cap stocks, the premium associated with this factor has diminished in recent years.

Several explanations for this trend include increased competition among investors, better access to information, and improved risk management practices. However, during the recovery in 2020/21, Size was an outperformer compared to other factors. Data suggests that Size is especially attractive during times of economic recovery.

Quality Factor

The Quality factor focuses on companies with strong fundamentals, such as high return on equity, low leverage, and stable earnings growth. Quality investing has gained prominence in recent years, as investors seek to mitigate risk and identify companies with sustainable business models. The Quality factor has been shown to be a valuable addition to multi-factor portfolios, offering diversification benefits and potential for outperformance.

The Quality factor has performed well over the past decade, with a generally stable premium. This suggests that the Quality factor has been relatively resilient, even during periods of market turmoil such as the COVID-19 pandemic.

The strong performance of the Quality factor can be attributed to various factors, including investors’ increasing focus on companies with sustainable business models, greater emphasis on environmental, social, and governance (ESG) factors, and the recognition of quality as a source of long-term value creation.

Implications Investors

The analysis of the Value, Momentum, Size, and Quality factors provides valuable insights for asset managers and investors seeking to capitalize on factor risk premia. The following points summarize the key takeaways from this study:

- Value: Despite a period of underperformance, the Value factor has experienced a resurgence in recent years. Asset managers should remain vigilant and adaptive to changing market conditions to capitalize on the potential return premiums associated with this factor.

- Momentum: The Momentum factor has generally been consistent in generating excess returns, but it is not immune to short-term fluctuations and periods of underperformance. Investors should understand the potential risks associated with Momentum investing and incorporate appropriate risk management strategies.

- Size: The Size factor has shown mixed performance in recent years, with the small-cap premium diminishing over time. Asset managers should remain cautious in their reliance on the Size factor and consider potential changes in its efficacy when constructing portfolios.

- Quality: The Quality factor has demonstrated strong and stable performance, suggesting its resilience and potential for long-term value creation. Investors should consider incorporating the Quality factor into their investment strategies to enhance portfolio diversification and capitalize on the benefits of quality investing.

Changes in factors over time:

We have seen that factors evolve differently over time and perform differently during specific market environments. Correlations between the considered factors suggest, that it is beneficial to combine them as some exhibit negative correlations to each other.

By doing so, the outperformance of one factor can make up the underperformance of another factor. If we then continue to apply weightings to the factors according to their short-term momentum, we can even minimize the impact of the underperformance by some factors in order to achieve an overall superior result.

| Market | Size | Value | Quality | Momentum | |

| Market | 1 | 0.347 | 0.082 | -0.568 | -0.326 |

| Size | 0.347 | 1 | 0.272 | -0.222 | -0.363 |

| Value | 0.082 | 0.272 | 1 | 0.183 | -0.181 |

| Quality | -0.568 | -0.222 | 0.183 | 1 | 0.111 |

| Momentum | -0.326 | -0.363 | -0.181 | 0.111 | 1 |

Conclusion

The development of factor risk premia, particularly for the Value, Momentum, Size, and Quality factors, has significant implications for asset managers and investors. By closely monitoring the evolving relationships between these factors and adapting the investment strategy accordingly, asset managers can better manage portfolio risk and potentially improve investment performance.

As markets continue to evolve, understanding the dynamics of factor risk premia will remain crucial for successful portfolio management and risk assessment in the field of factor investing and beyond.